Despite Corona crisis: property prices continue to rise significantly

The pandemic is leaving no traces on the market for single and two-family houses and condominiums. Rents, however, remain stable. Even the Corona crisis cannot stop the price increase for private homes.

In Frankfurt property prices have risen considerably during the corona crisis in Germany. The price increase for single-family and two-family houses continues unchanged. According to the report, prices for single and two-family houses rose by an average of 8.6 percent in the third quarter compared with the same period of the previous year.

This means that properties increased even more than condominiums, which were also significantly more expensive at 5.5 percent. According to the company, which advises cities and municipalities on setting up rent indexes, prices for private property had already risen sharply in the second quarter.

The Corona crisis has also changed housing preferences: In the face of lockdowns and home offices, many people value more living space or outdoor space, a recent survey showed. The areas surrounding metropolises are also becoming more popular.

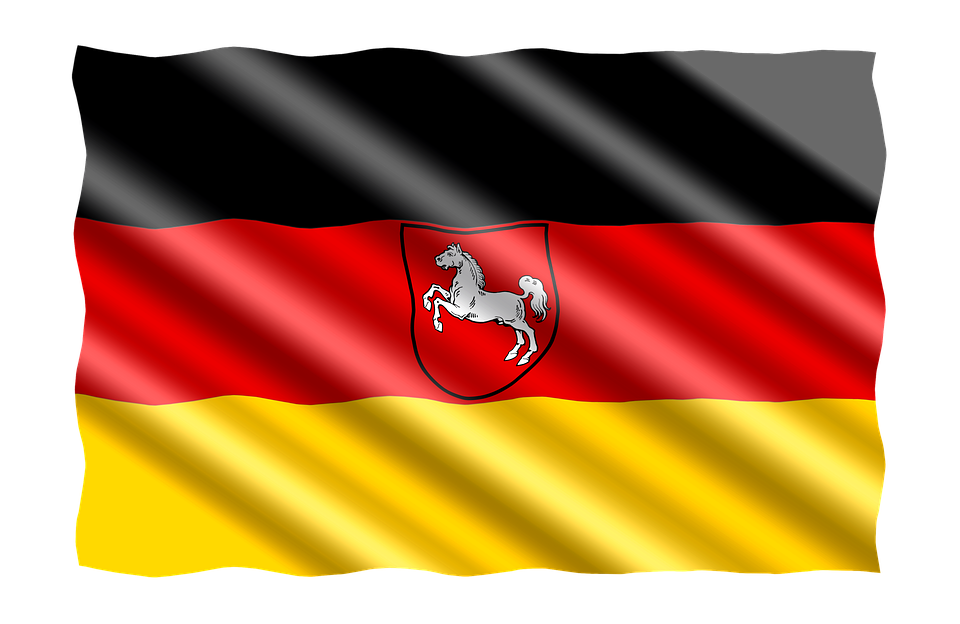

Quelle: handelsblatt.com Foto: dpa